milwaukee wi sales tax rate 2021

The December 2020 total local sales tax rate was 5600. Milwaukee County Wisconsin Sales Tax Rate 2022 Up to 55 The Milwaukee County Sales Tax is 05 A county-wide sales tax rate of 05 is applicable to localities in Milwaukee County in addition to the 5 Wisconsin sales tax.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

The Milwaukee County sales tax rate is.

. The December 2020 total local sales tax rate was 5600. The current total local sales tax rate in South Milwaukee WI is 5500. The Milwaukee County sales tax rate is.

Find easy and cost-effective sales tax filing for your business. Find your Wisconsin combined state and local tax rate. Sales and Use Tax.

Did South Dakota v. Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Wisconsin and beyond. Has impacted many state nexus laws and sales tax collection requirements.

Did South Dakota v. For single taxpayers taxpayers qualified to file as head of household estates and trusts with taxable income. The Wisconsin sales tax rate is currently.

The county sales tax rate of 05 is imposed on retailers making taxable retail sales licenses leases or rentals or providing taxable services in a Wisconsin county that has adopted the county tax. This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates.

The West Milwaukee sales tax rate is. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations based on the latest jurisdiction requirements. There is no applicable city tax or special tax.

The County sales tax rate is. The December 2020 total local sales tax rate was 5600. The 55 sales tax rate in Milwaukee consists of 5 Wisconsin state sales tax and 05 Milwaukee County sales tax.

776 rows 2022 List of Wisconsin Local Sales Tax Rates. The minimum combined 2022 sales tax rate for West Milwaukee Wisconsin is. Wayfair Inc affect Wisconsin.

The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543. Maximum Possible Sales Tax. What is the sales tax rate in West Milwaukee Wisconsin.

The December 2020 total local sales tax rate was 5600. Lowest sales tax 5 Highest sales tax 675 Wisconsin Sales Tax. For tax rates in other cities see Wisconsin sales taxes by city and county.

The county use tax rate of 05 is imposed on purchasers of items used stored or consumed in counties that impose county tax. Assessors Businesses Manufacturing Municipal Officials. Wisconsin sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Local tax rates in Wisconsin range from 0 to 06 making the sales tax range in Wisconsin 5 to 56. Average Sales Tax With Local. Groceries and prescription drugs are exempt from the Wisconsin sales tax.

To review the rules in Wisconsin visit our state-by-state guide. The following sales and use tax rates apply to taxable sales and taxable purchases made in the five Wisconsin counties in the baseball stadium district Milwaukee 55 includes 05 county tax Ozaukee 55 includes 05 county tax Washington 55 includes 05 county tax Racine 50. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

Wisconsin has state sales tax of 5 and allows local. Exact tax amount may vary for different items. Wisconsin Department of Revenue.

The County sales tax rate is. None of the cities or local governments within Milwaukee County collect additional local sales taxes. The Wisconsin sales tax rate is currently.

2022 Preliminary Manufacturing TID Report. The South Milwaukee sales tax rate is. Historical Sales Tax Rates for Milwaukee 2022 2021 2020 2019.

The Wisconsin sales tax rate is currently. Take the burden of sales tax compliance off your plate with help from Avalara AvaTax. Wisconsin has state sales tax of 5 and allows local governments.

Of the amount over. 2022 Wisconsin state sales tax. Thats why we came up with this handy Wisconsin sales tax calculator.

The minimum combined 2022 sales tax rate for South Milwaukee Wisconsin is. The Milwaukee County Wisconsin sales tax is 560 consisting of 500 Wisconsin state sales tax and 060 Milwaukee County local sales taxesThe local sales tax consists of a 050 county sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc. You can print a 55 sales tax table here.

The 2018 United States Supreme Court decision in South Dakota v. Average Local State Sales Tax. View details map and photos of this single family property with 3 bedrooms and 2 total baths.

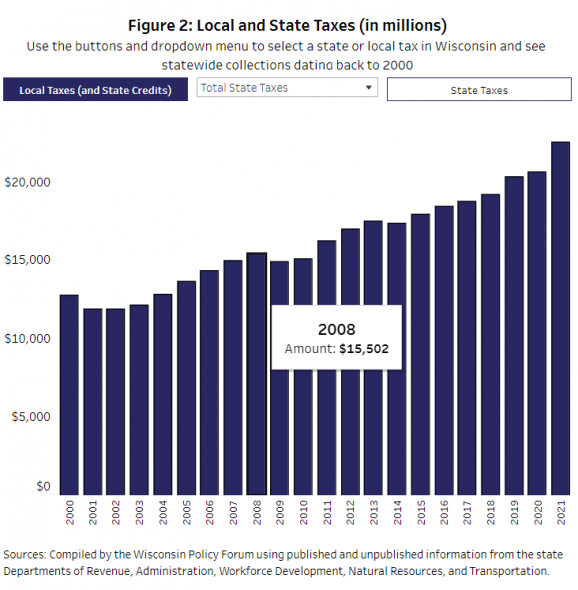

State Tax Burden Up But Overall Burden Still Falling Urban Milwaukee

Wisconsin Sales Tax Rates By City County 2022

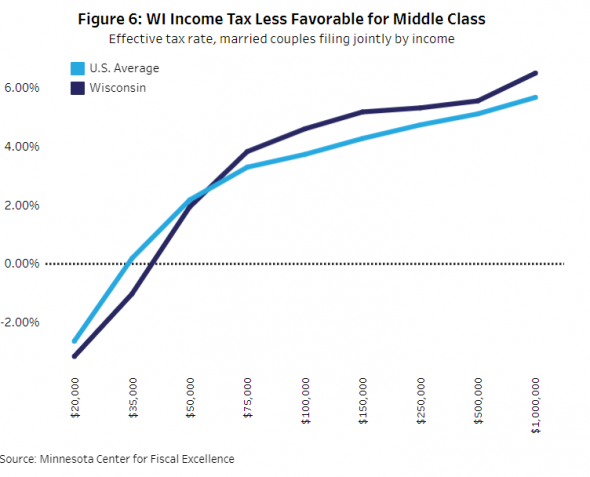

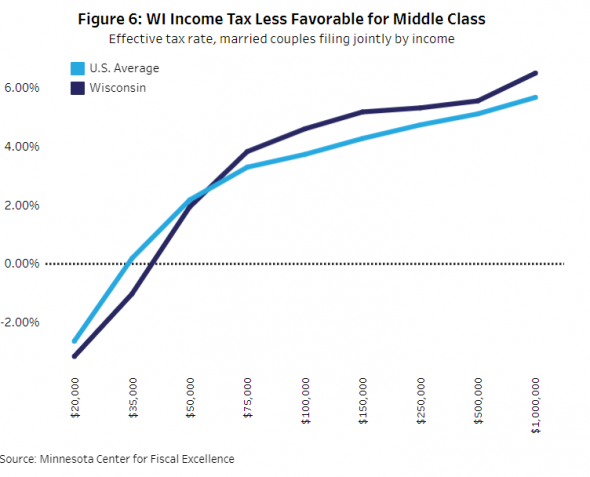

Wisconsin Losing Ground To Tax Reforming Peers

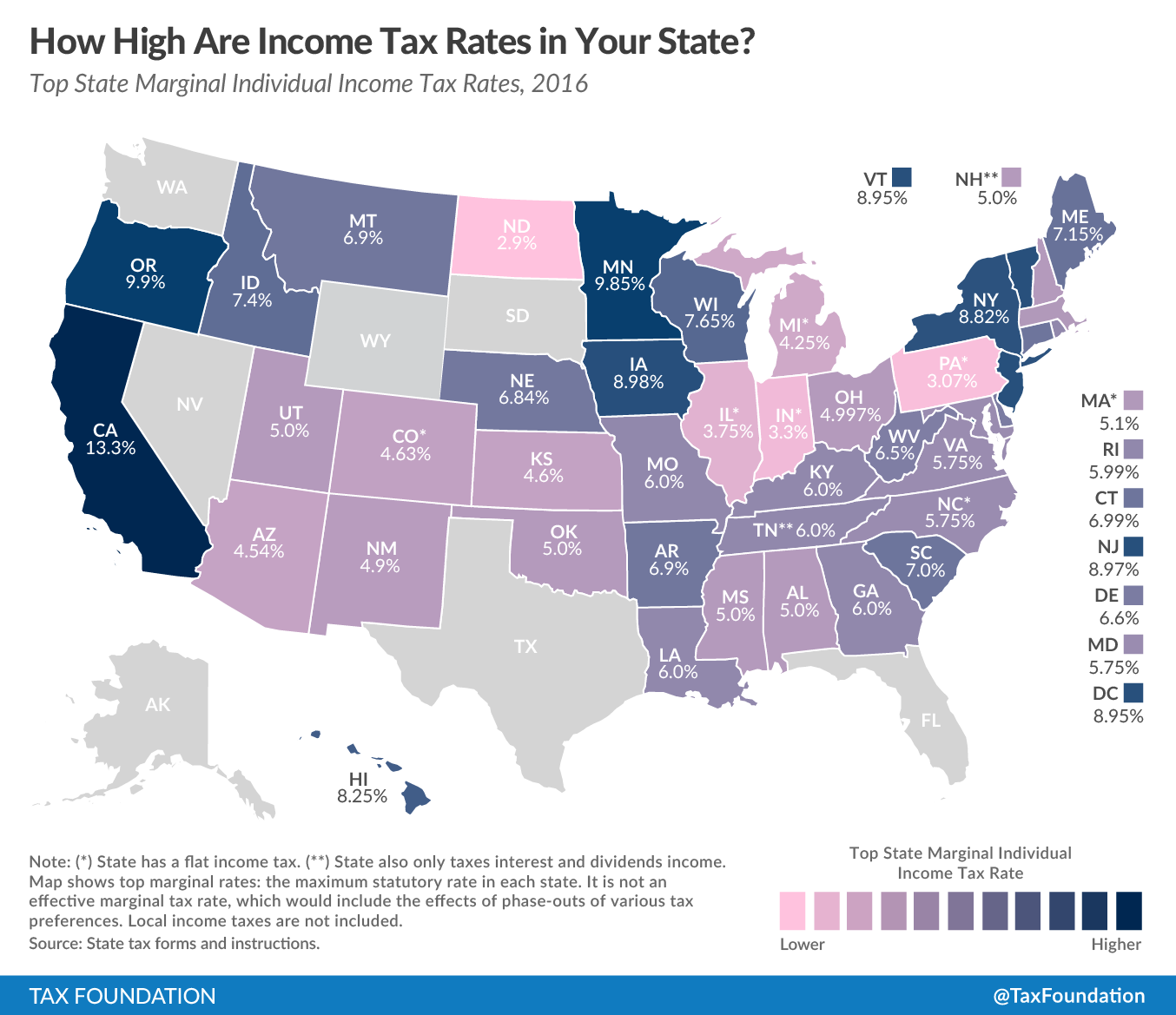

State Income Tax Rates Highest Lowest 2021 Changes

State Tax Burden Up But Overall Burden Still Falling Urban Milwaukee

North Central Illinois Economic Development Corporation Property Taxes

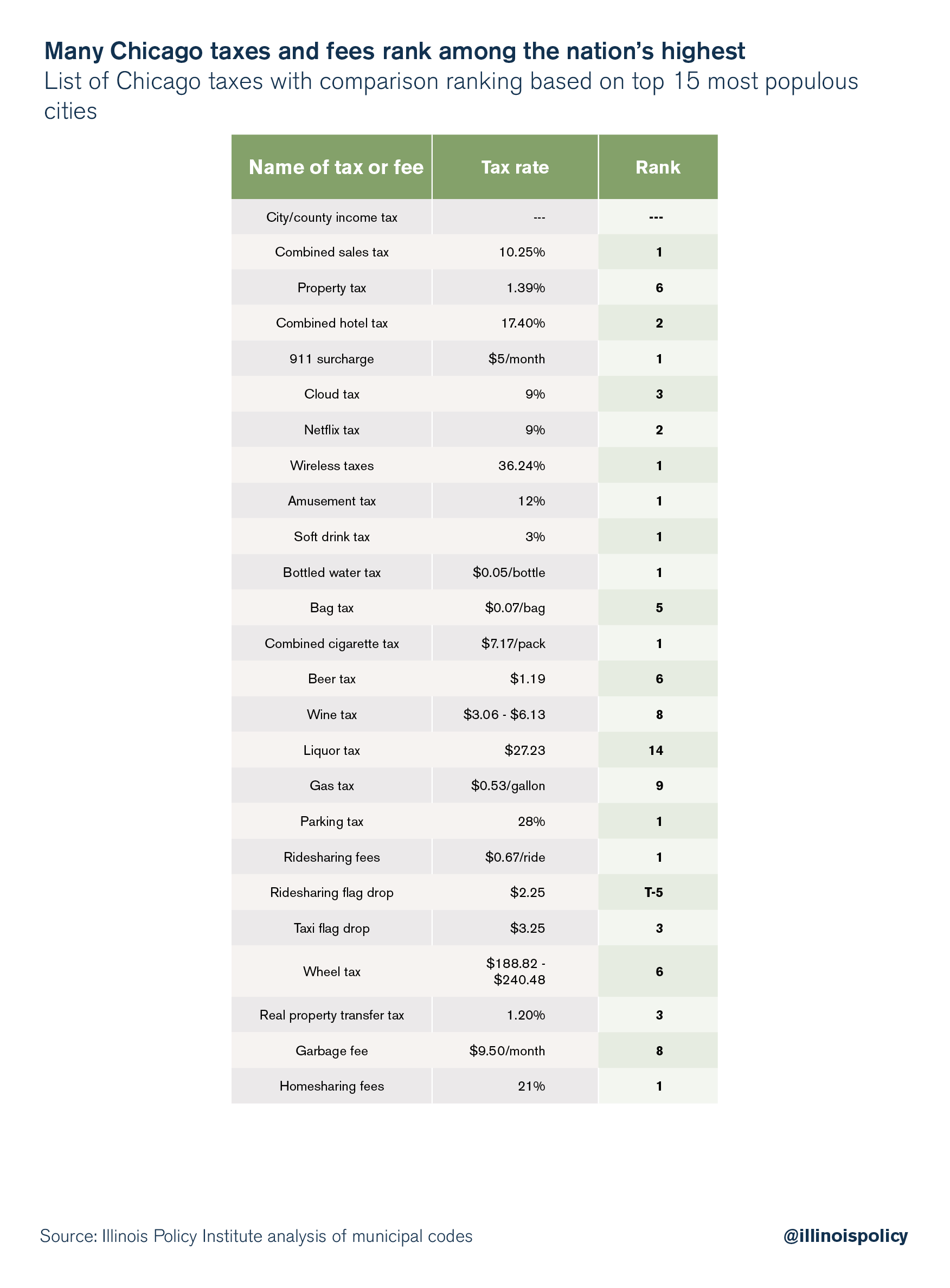

New Chicago Taxes Cheap Sale 57 Off Www Ingeniovirtual Com

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Revenue Wisconsin Budget Project

Wisconsin Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Sales Tax On Grocery Items Taxjar

A Glide Path To A 3 Percent Flat Income Tax Maciver Institute